A White Paper By Lisa Morales-Hellebo and Rico Gardaphe

Fashion’s rapid and dramatic transformation continues to create new winners and losers. Walmart’s $310 million acquisition of Bonobos has a lot of people in the industry scratching their heads, and a lot of investors wondering how to find similar success.

How will smart money find the right investment? They’ll look for fashiontech companies helping the ecosystem with its data, its supply chain management, or its entry into future commerce.

Setting the Scene

Brands, manufacturers, and retailers are shedding physical square footage, overhauling stale supply chains, and contemplating how to apply all the data now at their fingertips. “Fashiontech” is changing the game, and angel investors and VCs are talking about it with equal parts excitement and caution.

The definition of fashiontech has been a fun source of discussion and debate, but in essence, anywhere a technological solution is being applied to a fashion pain point, fashiontech is at work. Given the broad scope of this concept, investors can’t make a blanket bet on any start-up that claims the buzzword. They need to dig deeper.

The intense interest from angels and VCs in the fashion space in recent years has cooled as the industry’s turbulence took its toll on new ventures. Many investors want to wait for more dust to settle before they consider making another bet in fashion, but by then, they will have missed investing in the companies building the foundation of a new global market.

The good news?

Fashion is growing. A McKinsey & Co. and Business of Fashion study estimates the industry will grow by as much as 3.5% in 2017, and reach a value of $2.4 trillion worldwide. Anywhere growth and change appear simultaneously is an attractive place to look for start-up investments, and fashion is experiencing both.

Anywhere growth and change appear simultaneously is an attractive place to look for start-up investments, and fashion is experiencing both.

Digital Immigrants vs. Digital Natives

Fortunately or unfortunately for incumbent fashion industry players, start-ups smell blood in the water, and they’ve either come to bind wounds or to dine at this Darwinian feast.

“Digital Natives,” (those who were born in the digital era) namely Zappos, Amazon, ASOS, Zara, and others, have come to take market share of the “Digital Immigrants” (those born pre-internet and who had stores before websites) - Macy’s, J. Crew, The Gap, Nordstrom, and others.

Despite the headline-grabbing valuations and successful exits of some of the natives, plenty of investors have been burned by those who promised to be “The Warby Parker of __________.” Instead of walking away from fashion altogether, investors should focus on start-ups who have come to ‘bind the wounds,’ or help fashion companies (winners and losers, digital immigrants and natives alike) survive and grow in the new ecosystem.

The 3 Capability Pillars

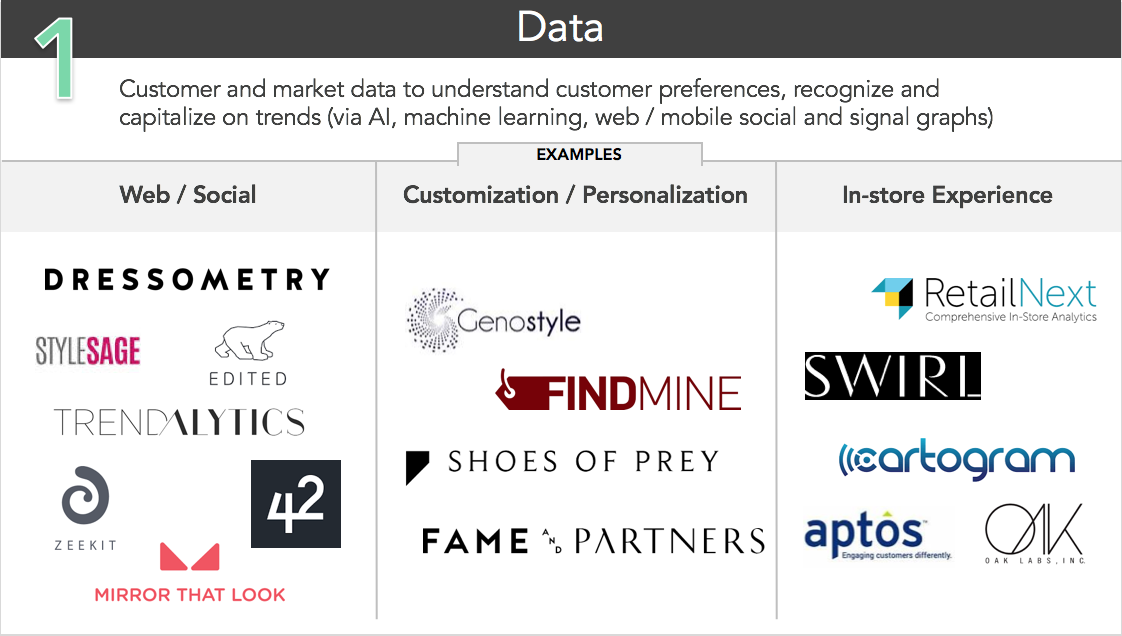

Among the many internal capability pillars fashion players will need to survive, three, in particular, apply across the value chain for companies both small and large, and will endure into the foreseeable future: data, supply chain, and future commerce. See the infographic below for some of the noteworthy companies doing exciting work in one of these three areas.

The B2B Opportunity

The fashion industry has been notorious for hesitating to embrace and apply technology. While mindsets are shifting quickly within fashion and retail C-suites, their capabilities will not. This presents a rich opportunity for B2B start-ups in the fashion space who focus on meeting one or more of those three pillars.

Building a large or loyal customer base and a strong brand often takes more time and investment than Angels or VCs typically can support. Like trends, B2C fashion players come and go every season - hardly comforting to a would-be investor.

In contrast, B2B players typically fly under the radar in the fashion industry and attract less competition. They face different challenges - they need to be equipped to survive longer sales cycles and to build connections to the decision makers of their target clients.

C-Suite fashion executives who feel growing pressure to keep their operations trim will be searching for contract solutions that are force multipliers for leaner staffs. Those solutions will increasingly come from start-ups with expertise in areas like data science and machine learning.

With the help of those start-ups, the efficiencies companies build today will lay the foundation for an iterative culture and flexible capabilities needed to compete over the long haul. Gone are the days where one competes with similar specs, product mix, and revenue. In fact, given some of the more recent acquisitions (e.g., Walmart of Bonobos, Hudson’s Bay of Gilt) it seems increasingly difficult to tell exactly who your competition is day to day. Technology is key to agility and agility is the key to surviving competition.

Stitching Together A Fragmented Ecosystem

Wherever you look across the value chain, from sourcing raw materials, to design and manufacturing, to discovery, point of sale and distribution, a different company is rewriting the way things are done for their particular corner of the ecosystem.

Mature industries never get the opportunity to reorganize from scratch, but this may be fashion’s best chance. Fashion’s digital renaissance, as it may come to be known, is being built before our eyes, and we have a unique opportunity to re-engineer how all its components fit together in a way that avoids future painful retrofitting (saving us all time, energy, brainpower, and money).

Investors must understand how the three pillars: data, supply chain, and future commerce intersect and support one another to identify the firms that will be there when it’s all rebuilt.

Don’t be Fashionably Late

Investors in the fashion space can be forgiven for feeling overwhelmed by the confluence of disruptive forces at work in the industry today: AR/VR/AI, 3D printing, wearables, outsourcing, insourcing, ethical sourcing, accelerating trend turnover, fit solutions, visual search, customization, personalization, contextual commerce, sustainability, fast fashion, and of course, data data data.

While almost everything about fashion is changing, like a savvy shopper, investors need to distinguish the fads from what’s here to stay.

Don’t wait until the winners take all.

---------------------

Lisa Morales-Hellebo

CEO & Founder

REFASHIOND

lisa@refashiond.com

Rico Gardaphe

Head of Operations

Dressometry

rico@dressometry.com